Issue 17 | AOFM Investor Insights | July 2025| PDF

Introduction

This edition of Investor Insights explores the role of hedge funds in the Australian Government Securities (AGS) market.

The AOFM issues AGS in ways that aim to attract a wide range of investors. This includes implementing an open and transparent issuance program. The key features of the AGS market that appeal to both hedge funds and the broader investor base include its strong credit, deep liquidity, robust legal framework, and the availability of highly liquid hedging instruments, such as bond futures and interest rate swaps.

The AGS investor base consists of both offshore and domestic institutions from the public and private sectors. These investors include central bank reserve managers, sovereign wealth funds, pension funds, asset managers, insurers, domestic and offshore banks, as well as hedge funds.

Hedge funds use various strategies to generate excess returns by capitalising on perceived market opportunities that may not be accessible to ‘traditional’ asset managers (for example the ability to short securities or use leverage). They generate returns from holding bonds through relative value strategies, arbitrage, and other metrics. Hedge fund strategies can vary from short-term tactical trading to longer-term macro strategies, where managers focus on broader market trends. While hedge funds can be significant investors and trade large volumes, they typically hold specific positions for shorter durations.

Hedge fund involvement in the AGS market

Hedge funds have been active investors in the AGS market for well over a decade. The AOFM regularly engages with hedge fund investors as it does with all investor types. These funds participate in both the secondary market and primary issuance, particularly in syndicated deals. While their holdings of AGS can vary, it is estimated that they account for between 5% and 10% of Treasury Bonds on issue at any given time.

Secondary market turnover

Hedge funds account for a significant portion of the Treasury Bond secondary market turnover. Market makers estimate that hedge funds make up around 25% of their secondary market turnover (excluding interbank); however, this figure can vary substantially over time and among dealers.

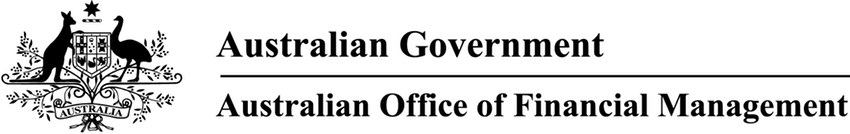

As shown in Chart 1, offshore investors contribute a much larger share of secondary market turnover compared to domestic investors. Hedge funds are predominantly located offshore, with active centres in Singapore, London, New York, Hong Kong, Tokyo, and Dubai. While Hedge funds typically hold positions for shorter durations and trade bonds more frequently than ‘real money’ investors, it is worth noting that other types of investors, particularly bank balance sheets and asset managers employing relative value strategies, can also be active traders.

Chart 1. Treasury Bond quarterly turnover

Source: AOFM. The AOFM relies on data provided by survey respondents and cannot guarantee the accuracy of this data.

Hedge fund use of repurchase agreements (repos)

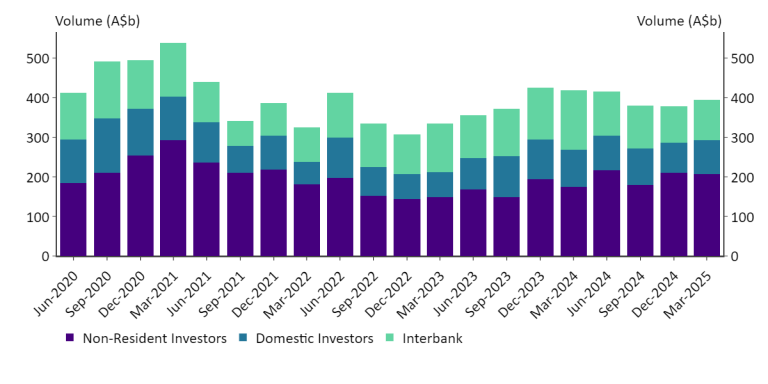

Chart 2 illustrates the use of repurchase agreements (repos) by non-residents. A repo is effectively a short-term, collateralised loan. Hedge funds often finance their positions in AGS through repos, making the availability and pricing of these agreements an important factor in their activity in the AGS market. The red line shows the net amount of AGS lent by non-residents. Repo activity won’t solely reflect hedge fund positions - other investor types such as asset managers and dealers can also use repos to fund AGS positions (although they can face greater restrictions due to balance sheet constraints and internal risk limits on how much leverage they are allowed to employ).

The chart indicates that the use of repos by non-residents for AGS purchases reached a low point in 2021 and 2022, although it has since increased. This downturn, from mid-2021, coincided with the RBA bond purchase program, a generally smaller issuance program by the AOFM and lower bond market volatility, which limited opportunities for implementing relative value strategies.

Chart 2. Non-resident use of repo

Source: RBA.

Hedge fund allocations in syndicated issuance

Syndicated issuance is an important part of how the AOFM issues AGS. In 2024-25, syndicated issuance accounted for $26.5 billion of a $100 billion Treasury Bond program and $800 million of a $3 billion Treasury Indexed Bond program. Syndicated issuance allows the AOFM to have greater control over the composition of end investors associated with a specific bond issue, compared to tenders.

In a syndicated deal, once the total amount of stock to be issued has been determined, investor orders are scaled and allocated. A key consideration is achieving a balance between allocating stock to 'buy-and-hold' investors and to those investors who are likely to trade the stock more quickly. Each syndication involves different circumstances in terms of volume, pricing, and stock allocation.

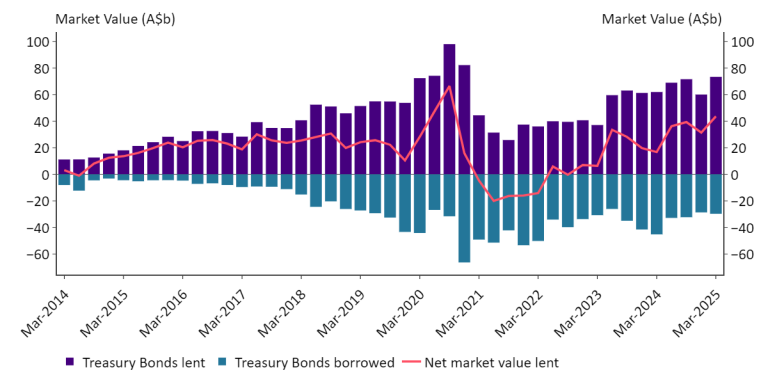

Chart 3 illustrates that the investor demand in Treasury Bond syndications is extremely strong with the volume of bids received well exceeding the amount issued. The recent $15 billion March 2036 syndication saw the highest order volume of any previous deal, with over $83 billion in orders. Consequently, substantial scaling was required across real money accounts, trading accounts, and hedge funds.

Chart 3. Treasury Bond syndicated issuance

Source: AOFM. The AOFM relies on data provided by survey respondents and cannot guarantee the accuracy of this data.

Chart 4 shows that since 2020, hedge fund allocations have ranged from 11% to 24% of total deal size. The AOFM maintains a consistent approach to allocations. Typically, between two-thirds and three-quarters will be allocated to real money investors, with the remainder going to hedge funds and trading accounts.

Chart 4. Treasury Bond syndication allocations

Source: AOFM. The AOFM relies on data provided by survey respondents and cannot guarantee the accuracy of this data.

The performance of a syndicated bond in the secondary market after a deal is an important consideration in the allocation decisions. Allocating too much to trading banks and certain hedge funds could lead to a large volume of selling in the secondary market after pricing and the bond underperforming. If a bond issued through syndication underperforms, it may disappoint investors, making them less likely to participate in future offerings. It may also weigh on the market and make it harder for the AOFM to issue following the syndication. On the other hand, a certain level of liquidity in the secondary market is desirable. If the bond is held too tightly after syndication, market makers may find it difficult to provide competitive two-way pricing in the secondary market.

Hedge funds rating process

The AOFM rates hedge funds with a view to scaling individual hedge funds at different proportions according to their investment style and our knowledge of each fund. The overall aim is to allocate a greater proportion to those funds which are less likely to sell the stock immediately after a deal. It should be noted that funds with a short-term tactical style are not necessarily ‘bad’. The rating framework is best viewed with reference to all factors taken together.

Investment Style – Hedge funds for that the AOFM considers having a medium-term investment horizon and consistent participation in the AGS market receive a higher rating than those considered as purely short-term tactical and entering and exiting AGS over time. Another consideration is the degree of leverage the hedge fund employs. All hedge funds have an element of short-term tactical and leverage, so judgement is exercised.

Meeting(s) held – Face to face meetings (including virtual) are an important means for the AOFM to understand how hedge funds view our market and their investment strategy.

Previous participation – Previous participation in syndicated deals provides an objective assessment of an investor’s support of the syndication process. Hedge funds are assessed on both the total amount they have been allotted at syndications as well as the number of the deals they have participated in, with a higher weighting placed on recent deals.

The hedge funds that have the highest ratings are those that have been active in the market for an extended period, have participated in a number of previous syndications, and are well-known to the AOFM.

Where a hedge fund operates from multiple regions, we usually assess each office (or ‘pod’) separately. In some cases, we will assess each region as one entity if the fund's global framework maintains a consistent investment approach across different office locations.

The AOFM may apply a percentage allocation based on the hedge fund rating. Additionally, the AOFM may implement caps and floors on allocations to discourage inflated orders and ensure a minimum allocation (if some investors receive too small an allocation they may sell as it won’t work in a portfolio).

Summary

Hedge funds have been active in the AGS market for over a decade and play an important role as part of a diversified investor base. They have the capacity to absorb a large amount of supply in a short period, and their trading activity can result in more efficient pricing on the bond curve. Their generally higher level of turnover can incentivise market makers to actively trade AGS, which can lead to improved liquidity and pricing for all investors. Hedge funds use of leverage, however, represents a risk that is important to acknowledge.

The majority of hedge fund activity in AGS occurs in the secondary market without direct involvement of the AOFM. Syndicated issuance provides investors, including hedge funds, the ability to purchase a larger amount of bonds than may be available through a regular bond tender or in the secondary market. The AOFM’s hedge fund allocation decisions balances the trade-off between secondary market price stability and liquidity.