Issue 18 | AOFM Investor Insights | November 2025| PDF

Introduction

This edition of Investor Insights explores the role of buybacks—repurchases of Australian Government Securities (AGS)—in the AOFM’s operations and their contribution to market functioning.

In this issue:

- The rationale for conducting buybacks

- The three methods used by the AOFM to repurchase bonds

- Recent trends in liquidity for short-dated bonds

Rationale for buybacks

Historically, the AOFM has repurchased Treasury Bonds ahead of maturity to:

- reduce refinancing risk

- manage cash flows around maturities

- support provision of secondary market liquidity

- encourage reinvestment into longer-duration bonds

- assist the RBA with liquidity management during bond maturities

Treasury Indexed Bonds (TIBs) may also be repurchased to support new issuance or improve market functioning.

Repurchase Methods

The AOFM has employed three main approaches to repurchase Treasury Bonds:

- Regular tenders - conducted directly with market makers, currently suspended;

- Syndicated issuance – buybacks offered alongside the launch of syndicated deals; and

- Transactions with the RBA - which acquired short-dated AGS prior to 2020 as part of its liquidity management operations.

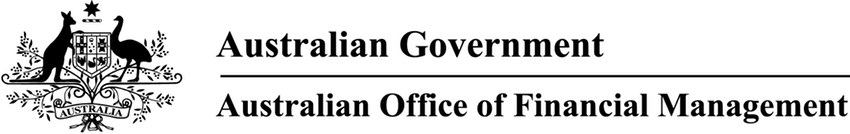

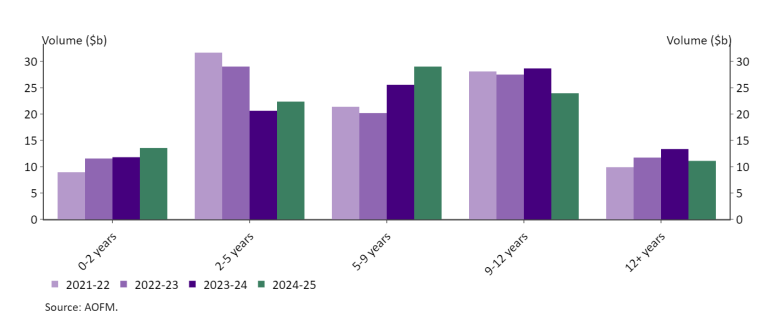

Chart 1 illustrates the three approaches the AOFM has employed to repurchase Treasury Bonds.

Chart 1. Buybacks of Treasury Bonds

Source: AOFM.

Buyback tenders

Buyback tenders operate as the reverse of standard competitive issuance tenders. In these operations, the AOFM sets a target volume for repurchase, and offers from intermediaries are accepted starting from the highest yield (i.e. lowest price), proceeding in descending order until the volume target is reached.

Historically this program was specifically aimed at bonds that had exited the three-year Treasury Bond futures contract. These short-dated bonds are often sold by investors to intermediaries, which can reduce overall market maker’s capacity to provide liquidity. By repurchasing these bonds from market makers, the AOFM facilitated reinvestment into longer‑dated securities, supporting broader market functioning.

The program was suspended in March 2020 following the RBA’s AGS purchases and remains inactive. Given the current funding task and limited free float of near-maturity bonds, systematic buybacks are not planned for the remainder of 2025–26.

A key consideration for the AOFM is that buybacks of bonds maturing in future financial years require additional issuance of longer-dated securities to fund them. To restart the buyback tender program, the AOFM would need to be confident that there is sufficient demand to absorb the additional longer-dated issuance, and that the buybacks would deliver a clear benefit to market functioning.

Buybacks in conjunction with syndicated issuance

The AOFM may offer buybacks of near-maturity bonds alongside syndicated issuance. These buybacks are conducted as separate transactions from the syndication itself. Bondholders may choose to participate in either the buyback or the issuance—or both. This approach offers several benefits to both the AOFM and the market. For bondholders, proceeds from the buyback can be reinvested into the new issuance, potentially increasing their allocation. For the AOFM, conducting a buyback in tandem with a syndication may facilitate a larger issuance size, thereby enhancing liquidity in the new bond line.

The buyback price is an important consideration for the AOFM, as surplus cash could otherwise earn a return comparable to the RBA’s open market operations. Participation is entirely voluntary—bondholders are not obliged to accept the buyback price offered by the AOFM.

Additional considerations for Treasury Indexed Bonds

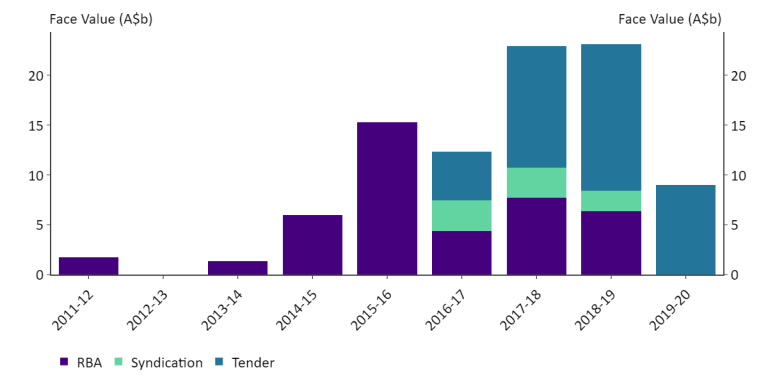

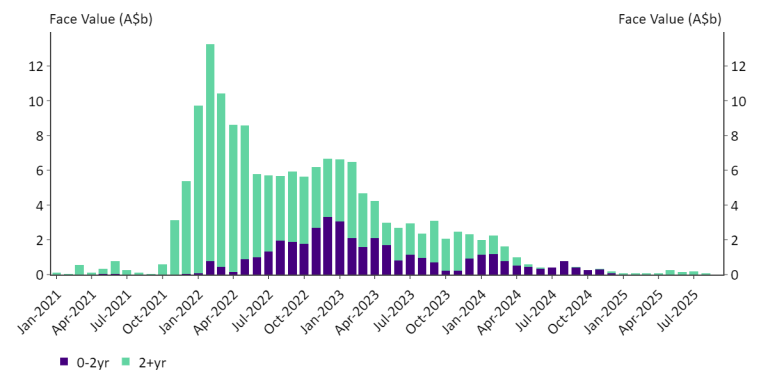

Near-maturity Treasury Indexed Bonds (TIBs) often lose their effectiveness as an inflation hedge and they may drop out of widely followed indexes. This can lead to reduced liquidity, as intermediaries face challenges making two-way prices for these bonds. As shown in Chart 2, in the past the AOFM has combined TIB buybacks with TIB syndicated issuance, a practice likely to continue when launching new lines.

Chart 2. Buybacks of Treasury Indexed Bonds

Source: AOFM.

Transactions with the RBA

Prior to 2019–20, the AOFM occasionally repurchased near-maturing Treasury Bonds directly from the RBA (as illustrated in Chart 1), which had acquired short-dated Treasury Bonds as part of its liquidity operations. These buybacks were undertaken solely for AOFM’s cash management purposes and not to support market functioning, as transactions between the AOFM and the RBA do not directly affect market liquidity.

For the Treasury Bonds acquired by the RBA during its bond purchase operations between 2020 and 2022, the RBA has indicated it will allow these holdings to run down as they mature.

Recent trends in liquidity in short-dated bonds

The AOFM actively monitors liquidity and trading conditions across the yield curve.

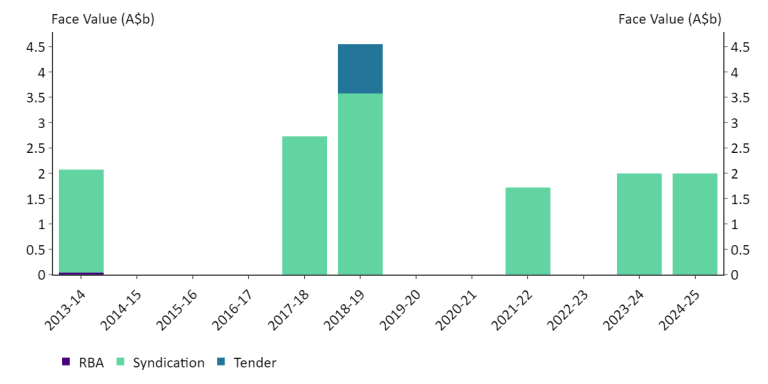

Chart 3 illustrates that AOFM’s issuance is primarily focused on the most liquid and actively traded parts of the curve, particularly around the ten-year futures basket. A substantial portion of near-maturing bonds are held by the RBA, which reduces the volume available for secondary market trading and can affect liquidity in those lines.

Chart 3. Treasury Bonds on Issue

Source: AOFM.

Secondary market turnover

As illustrated in Chart 4, secondary market turnover remains subdued for bonds with less than two years to maturity. However, since 2021–22, there has been a gradual increase in activity for short-dated bonds.

Chart 4. Treasury Bond turnover by tenor

Source: AOFM.

RBA and AOFM securities lending facilities

Another important indicator of market liquidity is the usage of the RBA and AOFM securities lending facilities. These facilities allow market participants to temporarily borrow bonds that are otherwise difficult to source in the secondary market. Elevated usage typically reflects limited availability of specific bonds.

Following the RBA’s bond purchase program and yield curve control measures in 2021 and 2022, demand for borrowing short-dated bonds through the RBA facility increased significantly. As shown in Chart 5, usage was particularly elevated from late 2021 through to 2024, highlighting the scarcity of bonds in the secondary market during that period. While the initial impact was most pronounced in three-year basket bonds, even near-maturity bonds were actively borrowed for a time.

Since mid-2024, usage of the lending facilities has declined markedly, indicating a return to more normal market functioning, even for short-dated bonds. Recent discussions with market participants support the view that the market is functioning well overall; although there have been a few occasions when price makers have been ‘long’ short-dated bonds. A signal to the AOFM that buybacks of near-maturing Treasury Bonds could be beneficial to overall market functioning would be if price makers are systematically warehousing a rising share of short-dated bonds.

Chart 5. RBA and AOFM Securities Lending Facilities

Source: AOFM.

Availability of Treasury Notes

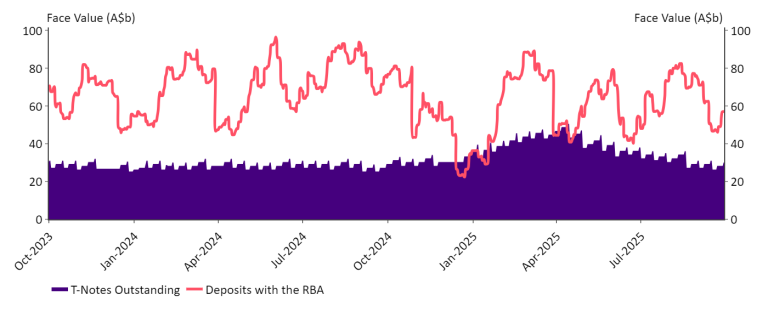

For many investors, Treasury Notes are an alternative investment to short-dated bonds. Chart 6 demonstrates that while the volume of Treasury Notes on issue varies based on the government’s cash requirements, the AOFM maintains a balance of at least $25 billion to maintain investor interest.

Chart 6. Treasury Notes outstanding and AOFM cash balance

Source: AOFM.

Looking Ahead

The AOFM may occasionally undertake buybacks of near-maturity bonds using excess cash balances, such as those arising from stronger-than-expected Budget outcomes, where market conditions and pricing are favourable. While a formally funded buyback program is not planned for the remainder of 2025–26, the AOFM regularly reviews this position. We remain prepared to conduct buybacks where there is a clear benefit to market functioning and where doing so would represent an efficient use of cash.