Australian Business Economists luncheon | Sydney

Anna Hughes, CEO

Before I deliver my 2025 address, I would like to acknowledge that we meet today on the traditional lands of the Gadigal people of the Eora Nation, who have been custodians of this land for thousands of generations. I pay my respects to their Elders – past and present – and extend that respect to all First Nations people who are here with us today. I recognise their continuing connection to land, waters, and culture.

I would also like to thank the ABE for the invitation to speak today and EY for providing this excellent venue. I see today as an opportunity to update the market on our Treasury Indexed Bond project as well as sharing an update on our funding task. I will discuss Team Australia and the role it will play in how we navigate ongoing market uncertainty. I’ll finish with a quick update on the AOFM’s recent organisational changes.

As you’ve come to expect, I will be as transparent as possible, and my aim today is to answer your questions as best as I can. That said, I’m mindful not to provide any information that could be misinterpreted as an indication of future action. Given the increasing geopolitical and economic uncertainty, the AOFM will need to maintain maximum flexibility so we can continue to respond effectively to changing market conditions.

Treasury Indexed Bonds

Let me start with our most under-appreciated funding instrument, the Australian Treasury Indexed Bond (TIB). Against a backdrop of heightened volatility and uncertainty, the last 12 to 18 months has been particularly challenging for the market. Changes to excise tax and the implementation of various subsidy schemes, while supporting households, have affected measured inflation adding more disruption and uncertainty to the TIBs market. Unlike the UK, there is no natural buyer because current legislation means that linkers remain off-benchmark for defined contribution superannuation schemes. The market also has fewer active participants resulting in a more concentrated investor base.

While the AOFM does not rely on or need TIBs for funding, we believe that well-developed financial markets should have a market-based measure of inflation expectations. This view is shared by investors, intermediaries as well as the Reserve Bank of Australia (RBA) and Treasury. We also recognise the importance of the asset class for the largely domestic investor base, who contribute additional diversity to the broader AGS investor base. Given this, we remain committed to supporting the market through stable and consistent issuance.

As part of this ongoing commitment to TIBs we recognise the need to remove barriers to investor participation where we can. As you all know, one of the challenges to attracting greater offshore interest lies in the structural differences between Australian TIBs and those issued in other developed markets. Specifically, most offshore sovereign linkers reference a monthly CPI and pay semi-annual coupons. Ours do not.

Thankfully, the opportunity for change is coming. The Australian Bureau of Statistics (ABS) has indicated that they are planning to transition to publishing a complete monthly measure of CPI from late 2025. This development presents a great opportunity for the Australian market, and we are currently looking at introducing inflation-linked bonds that more closely align with international standards, which should enhance their appeal to offshore investors.

It is our intention that any new TIB lines launched by the AOFM will use a pricing formula that references monthly CPI and pays semi-annual coupons. These new bonds should be:

-

easier for offshore investors to invest in

-

more responsive, with a shorter lag between realised inflation and returns

-

a cleaner measure of inflation expectations

-

potentially more liquid, benefiting both investors and AOFM; and

-

a natural fit for existing Treasury systems.

Given current ABS advice and the broader significance of this change, a patient approach is warranted. The first linker line referencing monthly CPI will come no earlier than fiscal 2026-27. This will provide time for the ABS to bed down its production schedule and for markets to gain some experience ‘trading’ the higher frequency data before we bring our first line to market.

We have already developed a draft Information Memorandum in consultation with AFMA’s inflation products committee. We will circulate this in advance of the first new TIB, and once some design elements have been finalised including the publication schedule for the new monthly CPI series.

Looking ahead to the day when we launch our new TIB referencing monthly CPI, it is likely to have a maturity of around 10 years. We’re confident that both the existing TIBs, which reference quarterly CPI, and the new TIBs can coexist in the market. That said, we recognise that some market participants will be keen to migrate to the new lines over time. We’ll listen to market feedback on potential consolidation opportunities as new lines are introduced. Here I must emphasise though that operational complexity and the overall cost to the Australian taxpayer will be key considerations when we are weighing up potential options.

While we’re relatively early in our journey to establish TIBs linked to monthly inflation, I’m confident – with contributions from many of you in this room – that this launch will be successful.

Issuance

I’d like to move now to our issuance task. I’ll start with outlining the Australian Government’s budget position, and how it will impact our task over the year ahead.

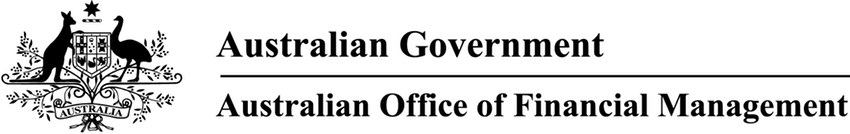

Chart 1: Australia's budget balance - underlying cash balance

As you would have seen from the March Commonwealth Budget, Australia has recorded budget surpluses over the previous two fiscal years and is currently forecasting to return to a modest deficit in 2024-25 and will remain in deficit over the forward estimates. An underlying cash deficit of 1 per cent of GDP is forecast for this financial year. The deficit is expected to reach 1.5 per cent in 2025-26 before improving to 1.1 per cent in 2028-29. It should be noted that these budget forecasts were made before the election and before the US announced its tariff policies in April. While there is much uncertainty on what effect these policies will have on Australia, there is good reason to believe that Australia is well placed to weather these impacts, not least because of the conservative assumptions factored into the Budget.

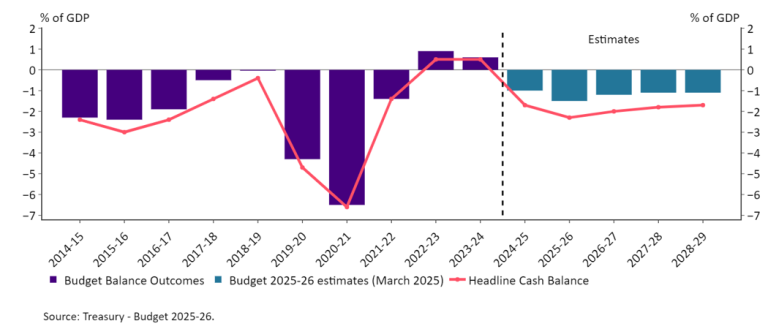

Following the release of the Budget, the AOFM advised the market that in 2025-26, it expected to issue around $150 billion of Treasury Bonds (including Green Treasury Bonds). This is a notable increase in both the gross and net Treasury Bond issuance compared to the previous three financial years. Adjusting for RBA holdings of maturing bond lines, net issuance absorbed by the market will be around $100 billion next financial year, up from around $50 billion this financial year.

Chart 2: Composition of Treasury Bond Issuance

TIBs issuance in 2025-26 is expected to be between $2 and $3 billion and will occur by tender. The next TIB syndication will be considered in the context of our move to the new formula and is not expected until 2026-27 at the earliest.

Regarding Treasury Notes, the floor of $25 billion on issue remains however as we look to our future financing tasks, Treasury Notes are likely to play a bigger role in how we manage cash flows within-year so our weekly issuance rate and the amount on issue may at times be higher than in the past.

More detailed guidance on issuance plans for the first half of 2025-26 (including any planned new maturities in the first half of the new fiscal year) will be provided in just over a week on 27 June 2025.

Working through uncertainty

Turning now to the activities that will underpin how we will make our way through the storm.

This is my third annual ABE speech and each year the speech seems to have uncertainty at its heart. This year is no different and I could easily argue that the events in April this year might be the beginning of the most uncertain times since the pandemic. As a sovereign debt management office, the AOFM has a unique and important role to play during times of market turbulence. The market looks to us to remain steady when certainty crumbles. For us, as an organisation, this is the time that we need to stay true to our key fundamentals.

The AOFM has a well-established approach to bond issuance and works hard at protecting our strong relationships with all market participants. We’d like to think that our market makers and investors know us well thanks to our transparent and predictable approach. We’d also like to think that we understand our market makers and investors well due to our ongoing engagement. In uncertain times, these relationships, plus the ones we have with the RBA and the Treasury, will come into their own.

Further supporting our ability to weather the storm is our large and diverse investor base. AGS appeals to investors for several reasons: the Commonwealth’s credit rating, deep market liquidity, and a positive investment environment backed by a strong and secure economy and comprehensive legal and regulatory framework. While the AOFM has no influence over these factors, we can and do spend a lot of time ensuring that investors recognise Australia’s strengths and understand how we differ from other issuers.

This is also where our role in Team Australia comes into the mix.

Team Australia

As we are all aware, part of the uncertainty story comes from the increasing amount of issuance both at the sovereign and semi-government level. As I mentioned, the AOFM has a deep and diverse investor base that has been built over many years. To support our semi colleagues, the AOFM is looking at ways in which we can leverage our networks. While we have historically undertaken joint marketing events, they have been predominantly targeting Japanese investors. With significant investor concentration in other markets, now is the time to look at other opportunities to promote Team Australia.

While individual marketing will and should continue it is becoming increasingly important that everyone of us delivers a consistent narrative about Australia’s strengths. Investors undoubtedly ask each of us similar questions and it’s important that stories align. With this in mind, the AOFM and semi-government issuers will work on understanding each other’s key messages and how they fit into the Team Australia narrative.

These projects exemplify what we can achieve when we take a unified approach to navigating market complexities and uncertainties. Together, we can ensure the strength and stability of our financial system in ways that benefit all Australians.

The AOFM’s future state

Before I finished, I’d like to update you on some organisational changes and my vision for the future of the AOFM.

For those of you with a keen memory, my 2023 speech outlined a conversation I’d had with one of my peers around the future of our respective organisations. The analogy this colleague used was that as new CEOs we are like new homeowners.

We bought the house because the foundations were solid and structurally there wasn’t any need to make material changes. Since then, the world has changed, our debt on issue has grown, and as I noted above this is my third ABE speech that is centred around uncertainty. Consequently, this amazing house, that is the AOFM, needs to increase its capacity by adding a second story.

In the first major organisational change to the AOFM since its establishment in 1999, I have created a Chief Operating Officer position and Deputy CEO position that will report directly to me. With this change, I have expanded the senior leadership of the AOFM from one to three. I believe that with this change the AOFM will remain well placed to navigate the future challenges we will inevitably face. These two positions will help future-proof our organisation so that the calm, responsible and prudent custodianship of the AGS market that you have seen from the AOFM over several previous crisis can continue. Our COO, Julia Hendrikson, will focus on ensuring that our processes and procedures enable us to continue delivering while protecting the well-being of our staff, particularly during more stressful times. Our Deputy CEO, Katina Kikitis will work closely with our stakeholders to maintain and strengthen our relationships. These positions will not only provide executive support to me, but they will also provide additional managerial support to the AOFM’s entire operations. Both Julia and Katina are here today, and I encourage you to introduce yourselves.

Summary

In summary, the AOFM is committed to maintaining a functioning TIBs market and will continue to work on a new product based on a monthly CPI formula. This is a complex program, and we will need to carefully navigate both the design and implementation of the new bonds.

While our issuance task for the next financial year is significant, the AOFM is well placed, thanks to our strong fundamentals which include our deep and diverse investor base and the strong relationships we have with market makers including many of you in this room. That said, we will remain committed to these fundamentals as we work to future-proof our organisation with this new leadership structure.

Thank you for your time this afternoon.